The bills are sudden and jarring: $1,400 for a computer part from Germany, $620 for an aluminum case from Sweden and $1,041 for handbags from Spain.

Some U.S. shoppers say they are being hit with surprise charges from international shipping carriers as the exemption on import duties for items under $800 expires as a part of President Donald Trump’s tariff push.

That’s leading to some frustration and confusion as shoppers and shippers both try to navigate a new reality for anybody ordering goods from abroad.

“It’s maximum chaos,” said Nick Baker, co-lead of the trade and customs practice at Kroll, a firm that advises freight carriers.

Thomas Andrews, who runs a business in upstate New York restoring vintage computers from the 1980s and 1990s, said he was shocked to receive a tariff bill from UPS for approximately $1,400 on a part worth $750. He said he assumed there must have been a mistake.

“That’s extortion,” Andrews said.

Late Friday, a representative for UPS told Andrews that the initial charge was indeed incorrect: The tariff bill should have only been for about $110. But it was too late: Andrews had already refused shipment to avoid paying the charge. Soon after learning about the corrected charge, he realized UPS had already begun sending the item back to Germany.

The final annoyance, Andrews said: He’s being charged for the return shipping — about $50.

In a statement, UPS said it has solutions available to merchants designed to navigate the new environment. It did not address the customer-billing situation.

On Aug. 29, for the first time in nearly a century, small-dollar items coming into the U.S. — also called de minimis goods — began facing import duties. That means even small, personal orders now face the sizable tariffs placed on U.S. trading partners. While a recent ruling by the U.S. Court of Appeals for the Federal Circuit found many of Trump’s duties unconstitutional, they remain in effect while Trump appeals the case to the Supreme Court.

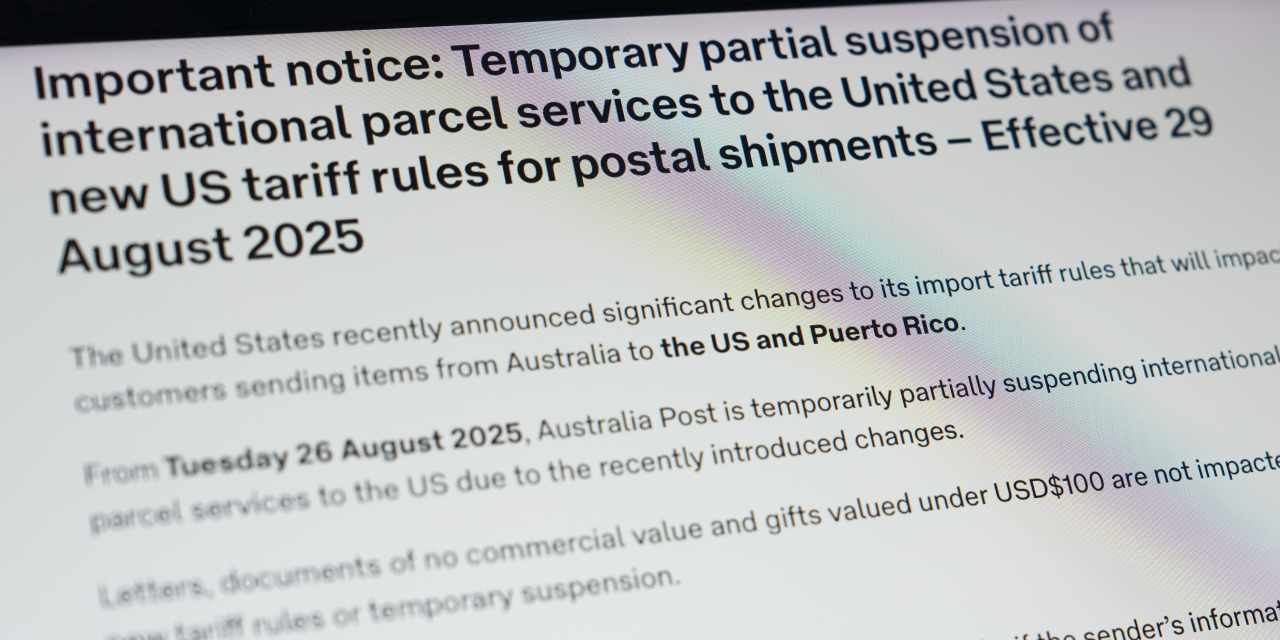

To comply with the new de minimis rules, a wave of countries have halted shipments to the U.S. That’s caused postal traffic into the U.S. to decline by some 80%, according to a United Nations agency.

But many orders are still flowing. And since the new de minimis rule began taking effect, social media platforms have been filled with accounts of U.S. customers receiving shock bills from major shippers like DHL, FedEx and UPS, having received no notice about the charges from the foreign merchant they’d ordered from.

The shippers, in turn, are being inundated with messages from customers disputing the charges, along with return-to-sender requests as the customers refuse shipments to avoid having to pay the bills.

A representative for DHL said the firm “is committed to supporting customers through the recent tariff changes and ensuring their shipments are managed efficiently.”

“We encourage customers to take note of the shipping policies of the brands they shop with and to also remember that tariffs are payable to the U.S. government,” it said.

The Trump administration has heralded the billions in revenues the tariffs are bringing in — and in the case of the new de minimis rule, argued the change is essential to halting the flow of small-sized illicit drug packages and drug ingredients. In a statement posted the day the new de minimis rules took effect, U.S. Customs and Border Protection said the logistics industry “has already adapted to the changes with minimal interruption.”

“This change has been months in the making, and we are fully prepared to implement it,” said Susan S. Thomas, acting executive assistant commissioner for CBP’s Office of Trade. “Foreign carriers and postal operators were given clear timelines, detailed guidance, and multiple options to comply. The only thing ending on August 29 is the pathway that has been used by criminals to exploit America’s borders.”

Baker said foreign merchants are obligated to provide information to the shipper about the classification of the item, which is key to the tariff calculation — but from a regulatory perspective, the customer, as the importer of record, is ultimately responsible for the accuracy of that information.

But many people are still getting caught off guard.

After receiving a tariff bill for $620 on a $300 aluminum computer case from Sweden, Robert Wang decided to turn the shipment away.

A software engineer in the San Francisco Bay Area, Wang said he placed his order Aug. 22 with Louqe, a high-end Swedish merchant. More than a week later, he received notice from UPS about the bill.

“Confusion transitioned into a late-night panic,” Wang said, as he frantically researched the situation. Eventually UPS confirmed he’d been charged the 200% tariff Trump has slapped on certain aluminum goods.

Wang said he tried to reach out to Louqe about the charge, but did not hear back. The company did not respond to a request for comment from NBC News.

Baker said many foreign businesses that rely on U.S. customers now face the dilemma of eating the tariff cost — assuming they are properly accounting for it in the first place — or passing it on to their customers, which could scare off business. Many merchants abroad have posted to social media to alert U.S. customers that they are suspending shipments there.

Some U.S. small businesses are also paying a price. A day after receiving a shipment from Spain for handbags he said were worth about $600, Herm Narciso said he and his wife, who run a brick-and-mortar shop in Dunedin, Florida, that resells goods from Europe, got a tariff invoice for $1,041.44 from DHL.

“We can’t understand how it’s possible to assess us with that level of tariffs,” Narciso said.

They said that they plan to file a dispute, but that the response could take two to four weeks. Narciso is worried their shop won’t survive the recent changes if they start getting similar bills going forward.

“This last quarter is probably going to tank us,” Narciso said. “The margins on this type of business are slim to begin with.”

He added: “It just doesn’t feel like the American way to me.”

https://www.nbcnews.com/business/consumer/surprise-tariff-bills-de-minimis-rcna229375