- The de minimis exemption, which allowed overseas orders under $800 to come into the U.S. duty-free, ended Friday. In effect, American consumers will experience less purchasing power for goods produced or sourced from other countries.

The de minimis exemption—a tariff loophole that for years made millions of direct-to-consumer imports duty free—is gone, and its end marks a structural shift for American shoppers and logistics providers.

Up until Friday, U.S. consumers could order up to $800 in goods per package from overseas without paying any tariffs or taxes. Now, this landscape is changing, adding to inflationary pressures that will squeeze everyday purchasing power, particularly for low- and middle-income Americans, experts tell Fortune.

“It’s a different shock to the system at a different level than what we’ve seen with the tariffs on large industrial goods,” Rob Haworth, senior investment strategy director at U.S. Bank, told Fortune. “It does start up another near-term challenge for consumers and for businesses and spending overall.”

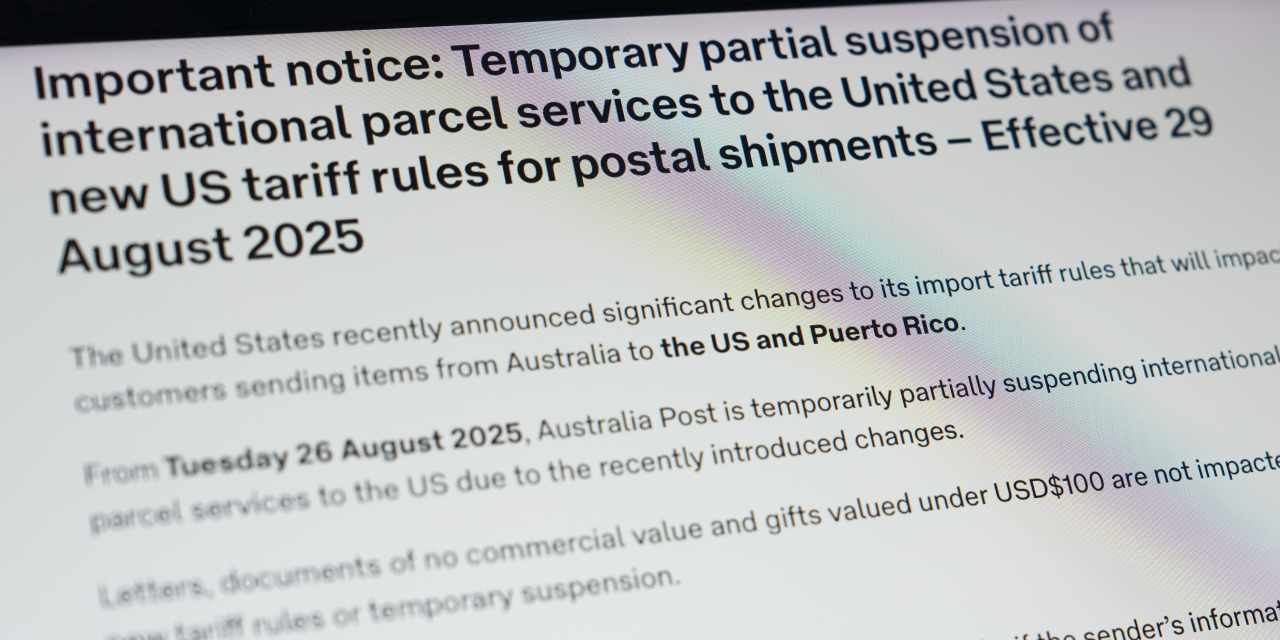

The de minimis exemption ended in May for imports from China, where an estimated three-quarters of goods under the $800 threshold came from, with a large share coming from e-commerce companies Shein and Temu. The de minimis suspension for parcels from all other countries implemented Friday now means the American dollar won’t buy as much as it used to, when it comes to shoppers purchasing goods made overseas.

“Categories like footwear and apparel will see some of the highest impacts, estimated at 15%-25% increased end consumer pricing, given the manufacturing origin often being China,” Sean Henry, CEO of Stord, an e-commerce and fulfillment company, told Fortune.

A senior Trump administration official said that the U.S. Customs and Border Protection agency has collected more than $492 million in additional duties on packages shipped from China and Hong Kong since ending the exemption.

And tariffs on goods that previously fell under de minimis could raise as much as $10 billion a year, U.S. trade advisor Peter Navarro told reporters Thursday. Putting that into perspective, the 2024 trade deficit in goods was $1.2 trillion.

“The net number (of tariff revenue without de minimis) is not all that meaningful in terms of how big the deficit is,” Baird Investment Strategist Ross Mayfield told Fortune. “The bigger difference is going to be the extent to which the government is levying these bigger, kind of broader swaths of tariffs.”

Over the past decade, the number of shipments entering the U.S. de minimis surged by more than 600%, from approximately 139 million in 2015 to almost 1.4 billion, according to U.S. Customs and Border Protection. However, the amount of revenue generated by these new tariffs depends on whether consumers are willing to continue to purchase cheap products from abroad.

“Nearly 40% of online shoppers abandon their carts when faced with these extra tariff and duty surcharges at checkout,” Stord CEO Henry said.

Lee Klaskow, a senior analyst of transportation and logistics at Bloomberg Intelligence, told Fortune he expects spending on these largely “discretionary” purchases to decrease.

“That Shein shirt that you really want that’s $5—maybe you’ll think twice about getting it because it’s going to be more expensive,” Klaskow said.

Prior to the pandemic, consumers had a “huge appetite for cheap things,” but Klaskow expects consumer behavior to flip in response to the change.

U.S. Bank’s Haworth said he’s more focused on how the government will implement the change, as it will require new systems, investment, and infrastructure to collect on small purchases.

He added the whole purpose of de minimis was to streamline the process of bringing small imports into the country, since they are more complex to track. The government has previously said this allowed illicit substances like fentanyl to cross into the U.S. more easily. Still, the system will need to recalibrate to adhere to the new rules.

“Originally why you had a de minimis exemption is so that you weren’t spending a lot of time on small transactions that didn’t net anything,” Haworth said. “So that’s kind of an interesting or challenging cost that is going to come into the business system.”